Circular 99/2025/TT-BTC (Circular 99), issued by the Ministry of Finance on October 27, 2025, will take effect on January 1, 2026. This Circular applies to all enterprises across industries and economic sectors operating in Vietnam and replaces Circular 200/2014/TT-BTC.

The objective of this update is to enhance operational flexibility, align Vietnamese Accounting Standards more closely with IFRS, and strengthen governance and internal control frameworks within enterprises.

1. Key Changes: Circular 99 vs. Circular 200

Circular 99 introduces significant reforms, granting enterprises greater autonomy in organizing and disclosing accounting information:

| Feature | Circular 200/2014/TT-BTC | Circular 99/2025/TT-BTC |

|---|---|---|

| Accounting Currency | Mainly VND; use of foreign currency requires approval. Standard accounting rules with VND. |

Flexible: Enterprises may choose a functional foreign currency as the accounting unit if conditions in clauses 2, 3, 4 of Article 4 are met. Additional rules for non-VND accounting units. |

| Chart of Accounts (COA) | Must comply with names, codes, and structure in Appendix I. | Enterprises may modify names, codes, structure, and content in Appendix II. Changes require issuing an internal accounting policy and legal responsibility for compliance. |

| Account Structure | 76 Account Level 1 (standard accounts). | 71 Account Level 1 (standard accounts). |

| Internal Control | No explicit requirements for internal control. | Mandatory establishment of Internal Accounting Regulations governing controls and responsibilities. |

| Financial Statements | Term used: “Balance Sheet.” | Renamed to “Statement of Financial Position” consistent with international reporting standards. Enterprises may renumber items sequentially but cannot alter item codes. |

2. Ekino Vietnam Updates for Sage X3 Vietnam Legislation Package to Comply with Circular 99

To ensure compliance with Circular 99, Ekino Vietnam is implementing comprehensive updates to the Chart of Accounts, posting rules, and financial reporting structures in Sage X3.

2.1. Account Removal

- Eliminate accounts related to purchasing costs, These costs will be recognized directly in Cost of Goods Sold (Account 632) or in Raw Materials (Account 152) and Merchandise Inventory (Account 156).

- Remove accounts associated with non-business funds and expenditures, which apply only to administrative accounting.

- Remove accounts for capital sources forming fixed assets, Construction costs will be recorded under Construction in Progress (Account 241) and transferred to Tangible Fixed Assets (Account 211) or Intangible Fixed Assets (Account 213) upon completion. Investment funding will be reflected in Other Payables (Account 338).

2.2. Account Additions

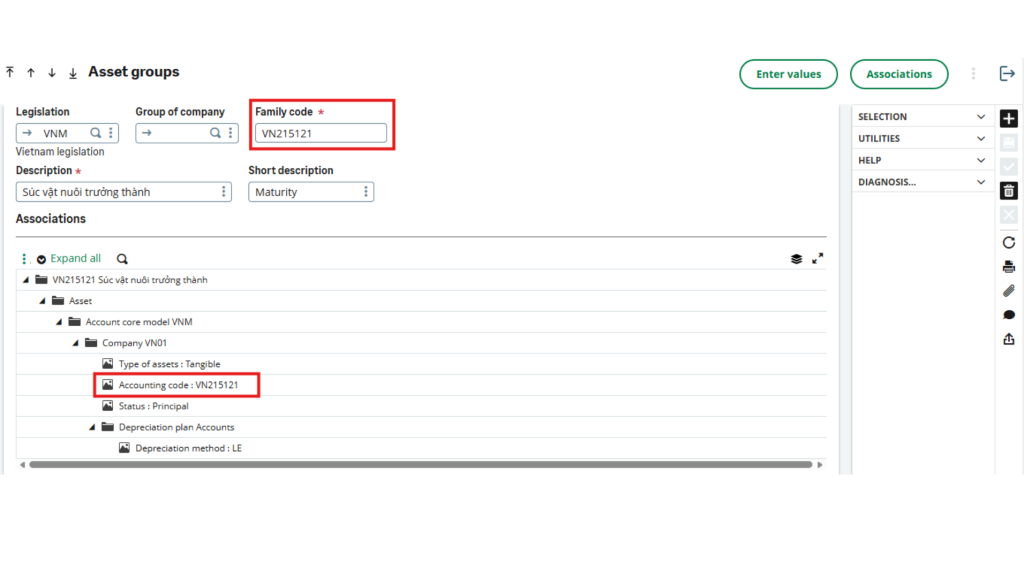

- Add Biological Assets (Account 215) to fully capture their value and changes.

- Add Special Consumption Tax on Imported Goods (Account 1383) for accurate tax obligation tracking.

- Add Payable Dividends and Profits (Account 332) for shareholder distributions.

- Separate Current Corporate Income Tax Expense (Account 8211) and introduce Global Minimum Tax Expense (Account 82112) to comply with prevailing tax regulations.

2.3. Mandatory Financial Statement Updates

Financial statement templates in Sage X3 are being revised per Appendix 4 of Circular 99:

- Rename Balance Sheet to Statement of Financial Position Statement; update and add item codes. Items without data are exempt from presentation. Enterprises may renumber items but cannot change codes.

- Circular 99 does not differentiate between short-term and long-term accounts. Therefore, in Vietnam Legislation V3.0, the Statement of Financial Position will present Account Level 1 and Level 2 under short-term groups, allowing enterprises to create detailed accounts for long-term items as needed.

- The Income Statement will include three new items: profit/loss from real estate activities, earnings per share, and diluted earnings per share for joint-stock companies.

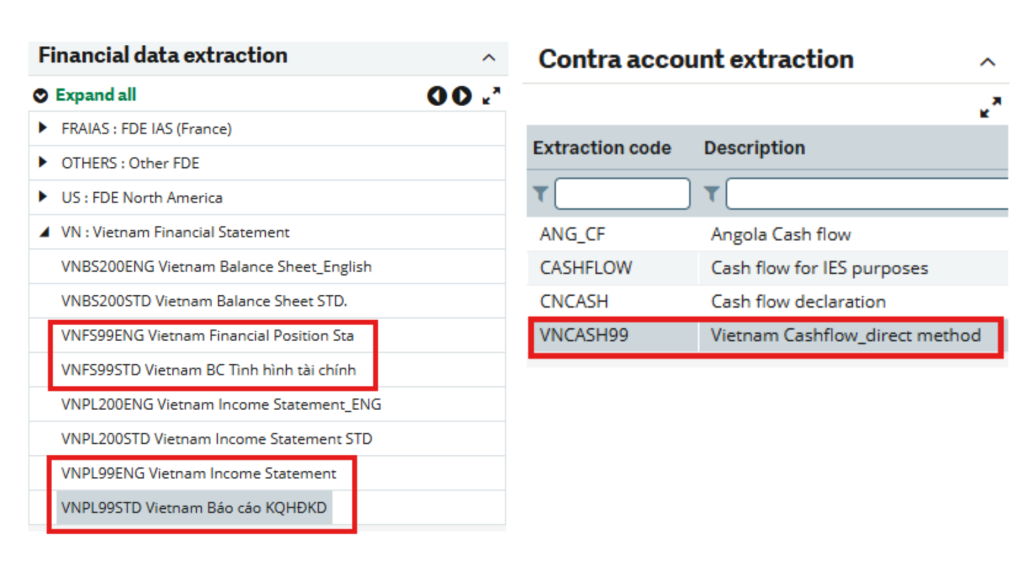

New reports in VNM Legislation V3.0 include:

- VNFS99STD: Vietnam Financial Position Statement (Vietnamese)

- VNFS99ENG: Vietnam Financial Position Statement (English)

- VNPL99STD: Vietnam Income Statement (Vietnamese)

- VNPL99ENG: Vietnam Income Statement (English)

3. Deployment Timeline

Ekino Vietnam guarantees deployment of the Vietnam Legislation V3.0 update in compliance with Circular 99 before January 1, 2026.