Inventory is an asset, but it is a volatile one. When products stop moving, they stop generating revenue and start consuming capital. This is the challenge of Obsolete Inventory (often referred to in accounting as dead stock or non-performing inventory).

For finance and operation leaders using ERPs like Sage X3, identifying and mitigating obsolete inventory is critical for maintaining healthy cash flow.

What Is Obsolete Inventory?

Obsolete inventory refers to goods in your possession that have reached the end of their product life cycle. These are items that have no forecastable demand and are unlikely to be sold at their original value, or perhaps at all.

From a financial perspective, these goods transition from being Current Assets to Non-Performing Assets. They sit on your books, inflating your inventory value while actively draining resources through storage costs and insurance, eventually leading to a financial write-off.

How It Differs from “Excess” Inventory

It is important to distinguish between the two:

- Excess Inventory: You have more stock than current demand requires, but it is still sellable. It is an efficiency problem.

- Obsolete Inventory: The demand is gone. The product is expired, outdated, or superseded. It is a valuation and loss problem.

Real-World Scenarios

- Expiration: A grocery distributor holds 500 units of yogurt that pass their use-by date. The asset value drops to zero instantly.

- Tech Obsolescence: A tool manufacturer launches a new drill model. The 5,000 units of the previous model still in the warehouse become obsolete because customers only want the new version.

- Seasonal Misses: A fashion retailer is left with 300 heavy winter coats in April. They are unsellable until next year, by which time trends will have changed, rendering them obsolete.

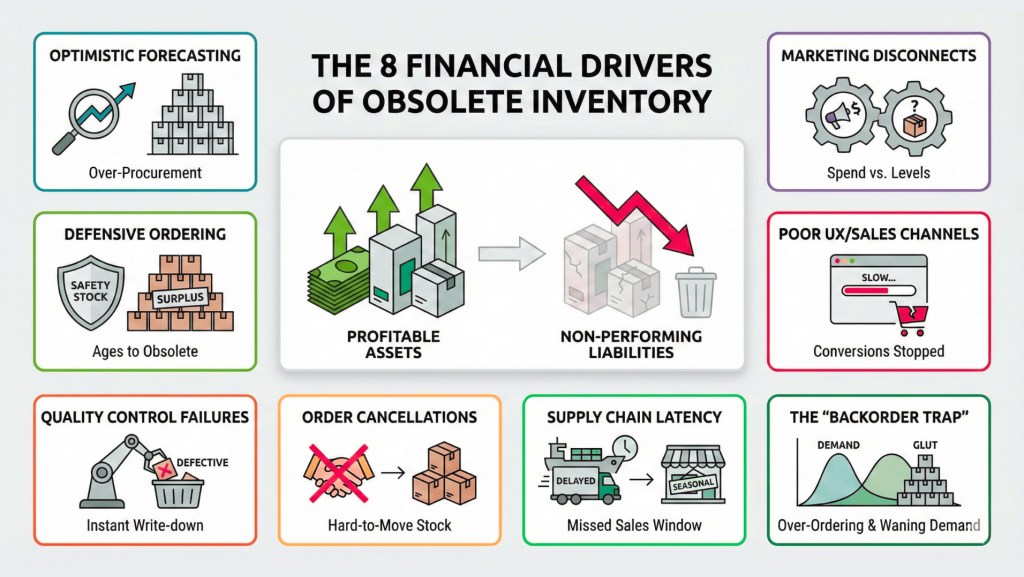

The 8 Financial Drivers of Obsolete Inventory

Why do profitable assets become non-performing liabilities?

- Optimistic Forecasting: Financial projections that don’t account for market downturns lead to over-procurement.

- Defensive Ordering: Buying extra stock to prevent stockouts (safety stock) often results in a surplus that eventually becomes obsolete.

- Marketing Disconnects: If marketing spend isn’t aligned with inventory levels, high-value stock can sit unnoticed until it loses relevance.

- Poor UX/Sales Channels: Friction in the buying process (e.g., a slow website) stops conversions, causing inventory to age out on the shelf.

- Quality Control Failures: Defective batches that cannot be sold must be written down, becoming instant obsolete stock.

- Order Cancellations: Large B2B orders that are cancelled late in the cycle leave you with distinct, hard-to-move stock.

- Supply Chain Latency: If lead times fluctuate and seasonal goods arrive late, they miss their sales window and go straight to the “obsolete” pile.

- The “Backorder Trap”: Over-ordering during a shortage often leads to a glut of inventory arriving just as customer demand wanes.

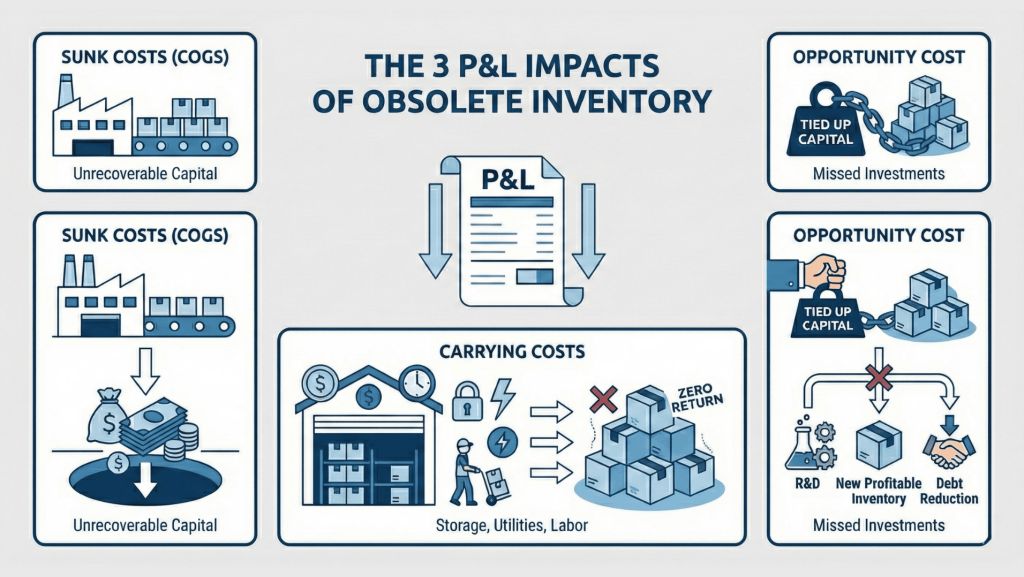

The True Cost: Why Obsolete Inventory Hurts ROI

The impact of obsolete inventory goes beyond the initial purchase price. It hits the P&L (Profit and Loss) statement in three ways:

- Sunk Costs (COGS): The capital used to purchase or manufacture the goods is unrecoverable.

- Carrying Costs: You continue to pay for warehousing, utilities, insurance, and labor to manage items that generate zero return.

- Opportunity Cost: The working capital tied up in obsolete stock cannot be used to invest in R&D, new profitable inventory, or debt reduction.

The Valuation Equation: If you have 100 obsolete units that cost $40 each to produce:

- Direct Write-off: $4,000.

- Lost Revenue: If they would have sold for $70, you also missed $3,000 in gross profit.

- Net Result: A $4,000 hit to the bottom line, plus monthly storage fees.

How to Minimize Non-Performing Inventory

You cannot control market shifts, but you can control your reaction to them.

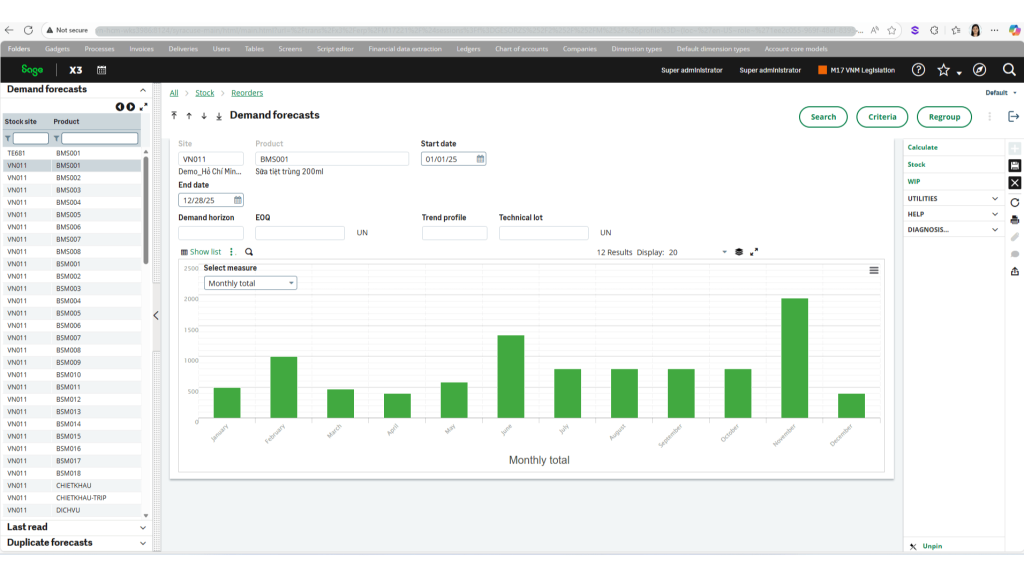

1. Data-Driven Procurement

Move away from gut-feeling orders. Use the Demand forecasts function in Sage X3 to generate precise projections over a specific Demand horizon. By utilizing Trend profiles and analyzing the detailed breakdown of monthly totals and weekly quantities, you can visualize exact seasonal fluctuations (such as identifying peak demand months versus slow periods). This accurate visibility aligns procurement with projected needs, preventing the over-buying that creates obsolete stock.

2. Automated Reorder Points

Set dynamic reorder points that adjust based on real-time sales velocity. This ensures you only tie up capital in stock that is actually moving.

3. Unified Visibility

Silos between Finance, Sales, and Operations create waste. When all departments view the same “single source of truth,” procurement can stop ordering items that sales has flagged as slow-moving.

Recovering Value: Managing the Write-Down

If you identify obsolete inventory on your books, act fast to recover whatever liquidity you can.

- Liquidation Channels: Sell the stock in bulk to liquidators. You will sell below cost, but you will convert a non-performing asset into immediate cash.

- Strategic Discounting: Offer deep discounts to clear the floor. recovering 50% of the cost is better than paying 100% of the storage.

- Donations: Donating inventory can provide tax benefits (deductions) and CSR (Corporate Social Responsibility) value, which can be more valuable than holding the stock.

- Vendor Returns: Negotiate with suppliers to return or exchange slow-moving goods before they become completely obsolete.

Final Thoughts for the Finance Team

Obsolete inventory is a silent leak in your company’s valuation. It inflates asset reports while draining cash flow.

By treating inventory management as a financial discipline, monitoring turnover rates, carrying costs, and lifecycle stages, you can minimize write-offs and keep your capital working for you.Is your ERP giving you the visibility you need? Discover how Sage X3 helps finance and supply chain leaders reduce risk and optimize inventory value. Contact Ekino Vietnam.