Overview of Decree 70/2025/ND-CP

Decree No. 70/2025/ND-CP was issued by the Vietnamese Government on March 20, 2025. This Decree amends and supplements several articles of Decree No. 123/2020/ND-CP dated October 19, 2020, which regulates invoices and vouchers.

Effective from June 1, 2025, Decree 70/2025/ND-CP introduces fundamental changes to how businesses in Vietnam manage and handle e-invoices. Among these, the abolition of the regulation allowing for the cancellation of e-invoices with errors is a significant change, requiring timely attention and adjustment from all accountants and businesses.

The Process for Handling E-Invoice Errors: Before and After Decree 70

Before June 1, 2025 (According to Decree 123/2020/ND-CP):

When an issued e-invoice was found to have errors, the process allowed for the following:

- The seller and buyer would create a written agreement acknowledging the error.

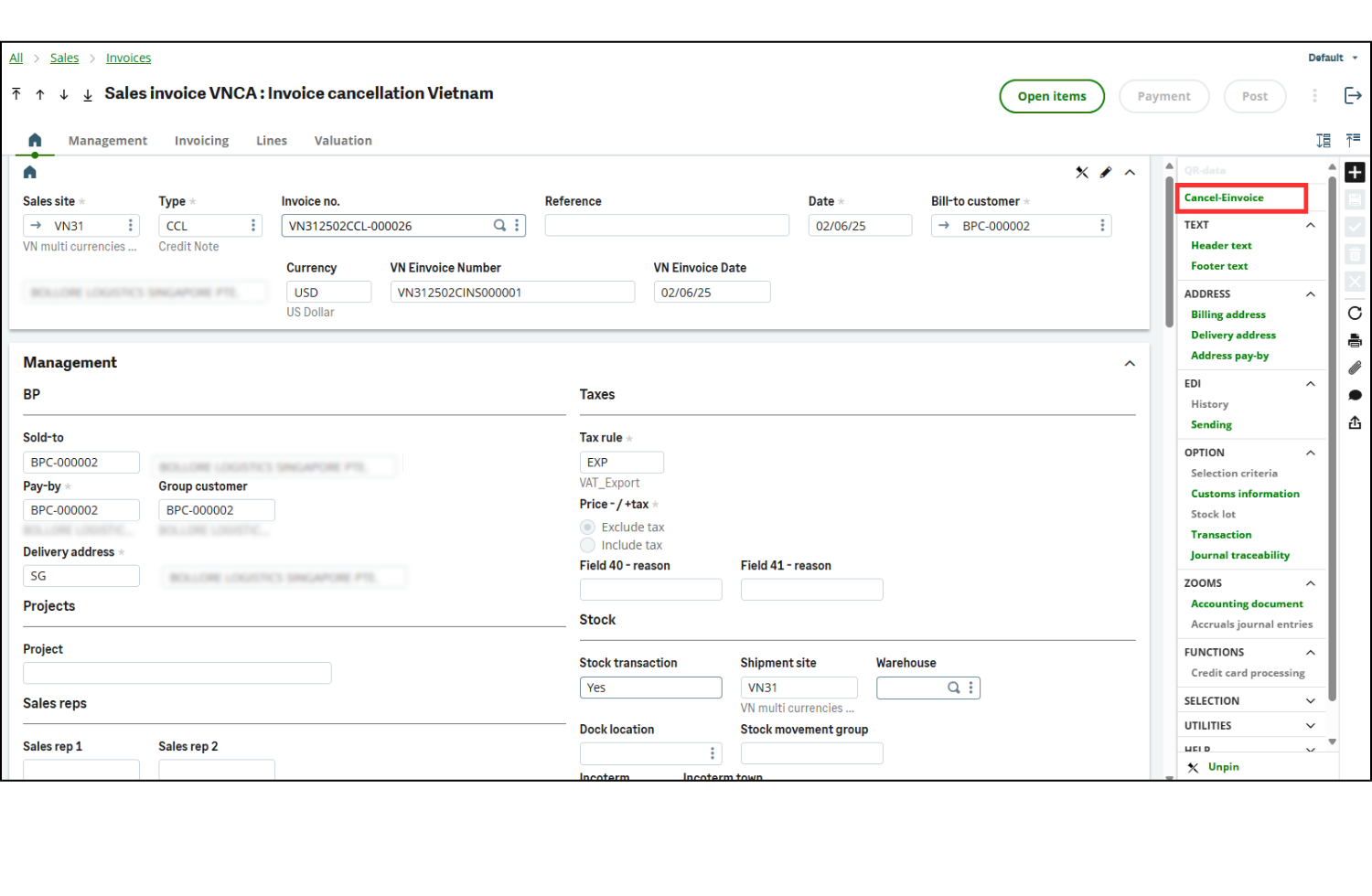

- The seller would perform the CANCEL action for the incorrect invoice in the software system. Below is the “Cancel Invoice” function in the Sage X3 eTool developed by Ekino Vietnam.

- The seller would issue a new e-invoice (with a new invoice number) to replace it.

From June 1, 2025 (According to Decree 70/2025/ND-CP):

The cancellation process described above is completely abolished. Instead, upon detecting an error, businesses are required to follow one of two methods:

1. Issue an Adjustment Invoice:

- Applicable when it’s necessary to correct a part of the original invoice’s content (e.g., wrong unit price, quantity, tax amount).

- The seller issues an adjustment invoice that clearly states: “Adjusts (increase/decrease) [content to be adjusted] for invoice No. …, Series …, dated …”.

- Both the original invoice and the adjustment invoice are legally valid in parallel.

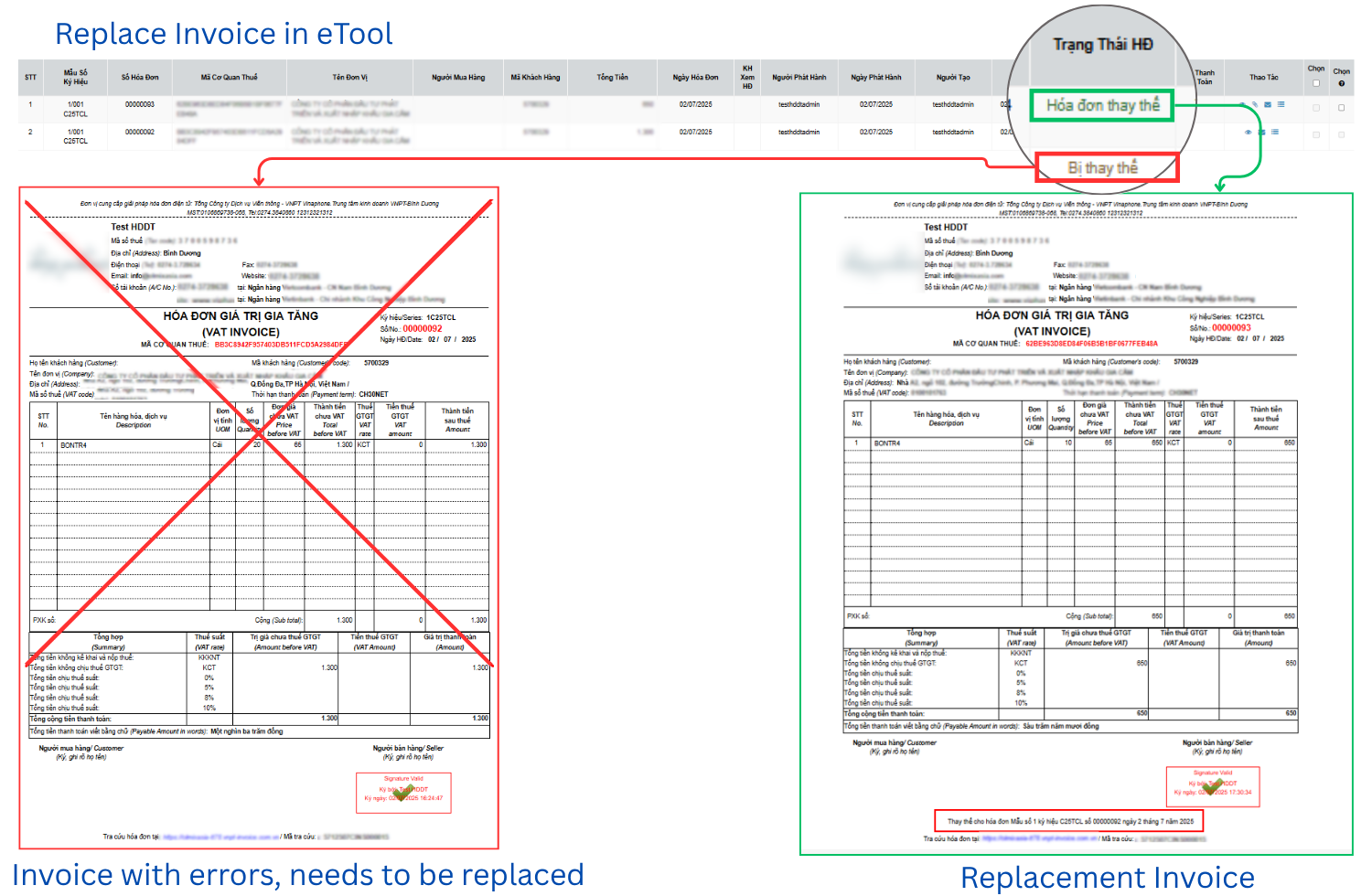

2. Issue a Replacement Invoice:

- Applicable in cases of serious errors or when the entire invoice needs to be replaced.

- The seller issues a new invoice that must include the text: “Replaces invoice No. …, Series …, dated …”.

- After the replacement invoice is issued, the original invoice becomes invalid.

Sage X3 in Vietnam and Compliance with Decree 70

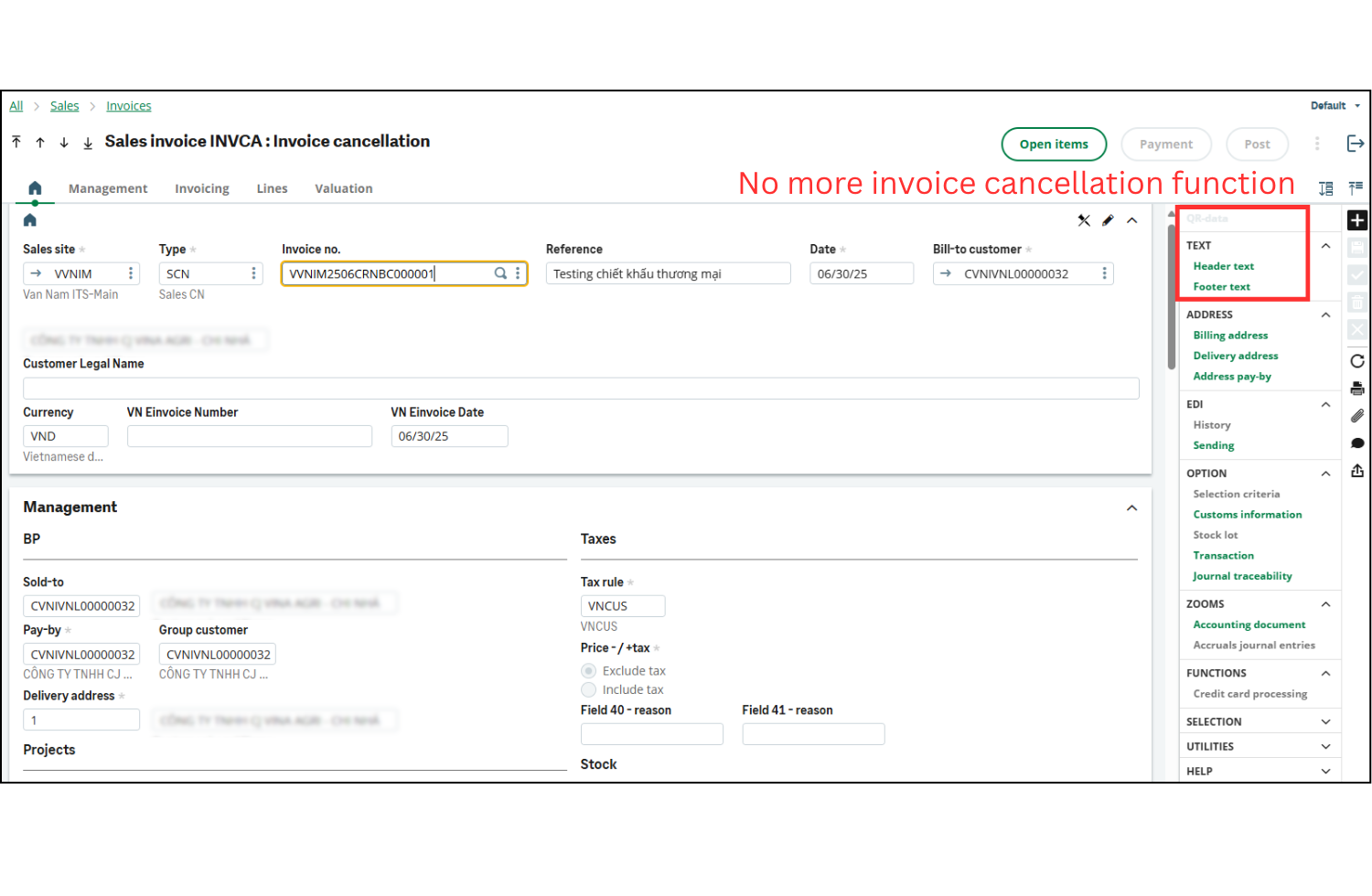

In the latest update for the integrated eTool on the Sage X3 system, Ekino Vietnam has removed the “Cancel Invoice” function. Instead, the error-handling process within the software has been reconfigured to be fully compliant with the requirements of Decree 70, only allowing users to perform the issuance of adjustment or replacement invoices.

In the face of significant legal changes, choosing an always-updated ERP system and a partner with local expertise is a critical factor. At Ekino Vietnam, we are committed to accompanying businesses on their journey. Our Sage X3 system is not just a global ERP solution but is also continuously updated to ensure absolute compliance with regulations in Vietnam.

To keep your business moving forward and in full compliance with the law, contact Ekino Vietnam’s team of experts today for a detailed consultation on Sage X3.